- Research reveals a connection between financial engagement and better outcomes, with high-savers regularly checking on their accounts and using a greater variety of professional financial services and tools.

- A majority of Americans plan to save some portion of their tax refund in 2024, but only 16% acknowledged that they did in 2023.

- Social trends are shifting, with more Americans openly discussing their financial habits and “loud budgeting” gains traction.

Santander Bank, N.A. (“Santander Bank” or “the Bank”) today announced findings from its inaugural Growing Personal Savings (“GPS”) Tracker, a new series analyzing how Americans approach growing their savings. The Santander Bank GPS Tracker revealed that higher-rate savings accounts including high-yield savings accounts, money market accounts and certificate of deposits (“CDs”) are each being used by less than 20% of the survey participants.

A general lack of financial knowledge is contributing to the low use of savings accounts that earn more interest, with only 18% of Americans rating themselves as being proficient or an expert on their finances. Those describing themselves as having lower financial knowledge were far more likely to be earning less than 3% in interest on their savings. For example, 80% of those that know their rate and describe their financial knowledge as “novice” were earning less than 3%. On the other end of the spectrum, 74% of those that know their rate and describe themselves as “experts” were earning 3% or more.

“Our study reveals an important link between financial knowledge and account engagement with savings growth and better outcomes for consumers. As a Bank focused on helping our customers prosper, we commissioned this research to uncover the challenges impacting savers and bring to light key actions that could improve the financial outcomes for them.”

Tim Wennes

CEO of Santander US and Santander Bank

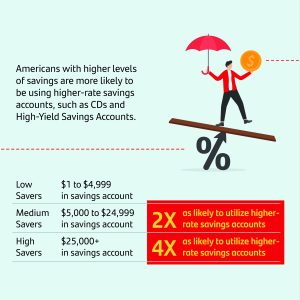

The study uncovered a relationship between savings totals and the use of savings account types that generally pay more interest. Medium savers (with $5,000 to $24,999 in their primary savings account) and high savers (with more than $25,000) are two-to-four times more likely to be utilizing savings accounts – such as High-Yield Savings Accounts and CDs – that generally pay more interest on savings. These savers were also two-to-three times more likely to have moved money in the past 12 months into an account that offered more interest.

Medium and high savers also exhibit specific financial behaviors more often, such as reviewing their account statements and information. They are also more likely to work with a financial professional or banker, more likely to save a portion of their tax return, and to conduct banking transactions digitally.

Americans Meeting Their – Generally Small – Savings Goals

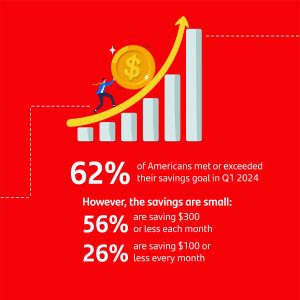

The Santander Bank GPS Tracker also explored Americans’ monthly savings goals. On average, a quarter (25%) of Americans didn’t have a monthly savings goal in Q1 2024. For those that did, about six in 10 (62%) on average either met or exceeded it. Millennial and Gen Z respondents in particular noted their savings balance total increased month-over-month in Q1, with an average of 62% and 61%, respectively, compared to Gen X (51%) and Baby Boomers (52%).

While Americans show momentum for saving, it’s often a small amount. More than half (56%) of respondents note their monthly savings goal is $300 or less. This includes a quarter (26%) who aim to save $100 or less every month. When asked what prevented them from reaching their monthly savings goal, more than half (56%) cited unexpected expenses as the key factor, while too many expenses or financial commitments (36%) and splurging on unnecessary purchases (31%) contributed.

More than half (57%) of Americans anticipate they will save at least some of their tax refund this year, despite only 16% saying they saved some of their tax return in the last year.

Loud Budgeting—Popular, Yet Unknown

The taboo of discussing finances with family and friends appears to be dissipating, with nearly half (48%) of Americans feeling comfortable doing so. Moreover, a majority of Americans (56%) said they are engaging in what could be described as “loud budgeting,” a new trend that gained popularity on social media platforms this year. Those who are loud budgeting openly declare to others that they cannot do something – such as attend a dinner or concert – because of their financial situation. Gen Z (64%) and Millennial (59%) respondents were the most likely to be engaging in this trend. While many said they are doing this, very few Americans (27%) were familiar with the term. Overall, nearly half of respondents (48%) say they are comfortable discussing their budget or financial goals with their family and friends.

Methodology

This research on growing personal savings, conducted by Morning Consult on behalf of Santander US, surveyed 2,203 Americans adults. This Q1 study was conducted between March 16-18, 2024. The interviews were conducted online with a margin of error is +/- 2 percentage points. This data was weighted to target population proportions for a representative sample based on age gender, ethnicity, region and education. Monthly measures were based on additional monthly survey pulses of approximately 2,200 Americans adults. The monthly iterations were conducted January 17-19, February 16-18 and March 15-17 to measure month-over-month changes.

The full report and more information about the Santander Bank, N.A. survey and its future quarterly updates can be found here.